Updated: October 2025

(Affiliate Disclosure: This post contains affiliate links, meaning I may earn a commission if you make a purchase through my links at no extra cost to you. I only recommend products and services I personally use and believe will add value to your financial freedom journey. Thank you for supporting Abundant Cents!)

I’ve always found that what we believe, we often end up living. Mindset plays a critical role in every decision we make, especially financial ones. A lot of folks don’t realize how much their mindset can act as a wall, keeping them from reaching their financial goals.

The whole deal with fixed versus growth mindsets might sound a bit like psych class, but stick with me here. When you’re stuck in a fixed mindset, you might think your abilities, smarts, and talents are just set in stone. This kind of thinking can really clip your wings when it comes to taking on financial challenges or trying new money-making strategies. On the flip side, having a growth mindset opens you up to learning from mistakes and taking calculated risks that could pay off.

It’s wild how certain beliefs about money get passed down as if they’re fact. You know, things like “money doesn’t grow on trees” or “rich people are greedy.” These common myths can seriously stunt your financial progress if you never stop to question them. It’s crucial to separate these myths from reality to make smarter money decisions. Understanding how to achieve financial freedom step by step starts with questioning these inherited beliefs.

Now, there’s actual science backing the connection between mindset and financial success. Studies show that people with a positive financial mindset often experience lower stress and better money management habits. The brain is pretty fascinating, and understanding more about how it works can give you a leg up when you’re trying to reshape your financial beliefs.

Next time you’re making a money decision, whether it’s investing in a new venture or just managing your daily budget, take a moment to check in with your beliefs. Are they holding you back or pushing you forward? That mindset check can be the first step towards breaking down those financial barriers.

The Role of Subconscious Programming in Financial Habits

You know that little voice in your head that talks to you when you’re making a money decision? That’s not just you overthinking things—it’s your subconscious programming. Think of it like the stuff running in the background influencing all the big and small financial choices you make, often without you even realizing it.

These patterns usually start shaping up early in life, based on what we hear, see, or experience about money. You might pick up on family attitudes without realizing it, like always saving ‘just in case’ or feeling anxious every time you check your balance. Understanding the psychology behind your bad money habits can help you identify these patterns and break free from them.

Spotting these limiting beliefs is tricky because they’re often so ingrained you view them as the truth. Maybe you believe you don’t deserve wealth, or you’ve got it in your head that financial success always requires huge sacrifices. These ideas can set up unconscious roadblocks, tripping you up at every turn. Learning to break bad money habits is essential to moving forward.

Here’s the good news: once you’re aware of these hidden scripts, you’re in the driver’s seat. The first step is getting honest and identifying those beliefs. Look back at your financial history and ask how much of it was driven by these deep-down beliefs rather than informed decisions.

Then, it’s all about making a conscious effort to change. Mindfulness techniques, such as daily affirmations or visualization, can help retrain your brain to adopt more positive financial habits. You can even keep a money journal to track your thoughts and decisions. This helps connect the dots between what you think and how you act financially.

Over time, you’ll find these old patterns loosening their grip, giving you more freedom to pursue new financial opportunities. Like any programming, it might take a few rounds of updates, but the payoff—both financially and emotionally—is worth the effort.

How Subconscious Beliefs Impact Your Financial Mindset

Fear is one powerful emotion, and when it comes to money, it can paralyze us. You ever find yourself hesitating to make a financial move, even though deep down you know it might be the right step? That’s fear of failure talking, and it can lead to what’s known as financial inertia.

Financial inertia is pretty much what it sounds like—staying stuck, not acting, because you’re scared of the outcome. It could be delaying starting an investment because you’re terrified of loss, or passing up a new job opportunity because it feels too risky. If you’re struggling to move forward, understanding why you can’t save money might reveal some of these mental blocks.

Recognizing fear of failure starts with getting honest about what exactly is holding you back. Is it the fear of losing what you already have, or maybe the fear of judgment from others if things don’t pan out? Once you’ve figured out where that fear is coming from, you’ve already taken a big step toward overcoming it.

One way to tackle this fear is by reframing it. Think of challenges as opportunities to learn rather than potential failures. There are plenty of people who have faced the fear of financial failure and come out stronger—and one day, that could be you flipping the script. Building solid savings tips for every budget can also help reduce financial anxiety.

Consider making small, calculated risks to start. This doesn’t have to be all-or-nothing. Dipping your toes in can help build confidence without stepping too far outside your comfort zone. Find inspiration in stories of people who faced their fears and saw amazing results—it’s a reminder that those who dare to take the leap often land on their feet, richer in both experience and, ultimately, financially.

Cultivating an Abundance Mindset for Financial Growth

Shifting to an abundance mindset can really change the game when it comes to handling your finances. Rather than seeing the world as a place of limited resources, an abundance mindset lets you view it as full of opportunities and possibilities.

This shift starts with recognizing what an abundance mindset looks like. It’s about focusing on the potential for growth and possibilities rather than what’s lacking. You’ll often find people who embody this mindset are more open to change, quicker to see solutions rather than problems. This mindset is essential when you’re working toward financial freedom.

Making the transition from a scarcity mindset to one of abundance isn’t just about thinking differently; it’s about putting those thoughts into action. Starting small with daily practices such as gratitude exercises can be incredibly effective. By acknowledging and appreciating what you have, you set the stage for attracting more of it. Exploring passive income ideas can also reinforce abundance thinking.

There are real success stories out there of folks who embraced this way of thinking and saw significant improvements in their financial situations. They didn’t just amass wealth; they also felt more satisfied and less stressed. Hearing these stories can be inspiring and can motivate you to adopt a similar mindset.

Looking at the long-term benefits, maintaining an abundance mentality can enhance your decision-making and create a more positive financial future. Over time, this mindset not only helps in accumulating wealth but also contributes toward a healthier relationship with money and lowers stress levels. Whether you’re exploring passive income methods or building multiple income streams, an abundance mindset is your foundation.

Cultivating an abundance mindset takes commitment, but the shift can lead to substantial financial and personal growth.

Actionable Strategies to Strengthen Your Financial Mindset

Shifting your mindset takes time, but these simple steps can guide your journey:

- Break down financial goals into manageable steps

- Track your spending and identify patterns using our financial calculators

- Practice daily affirmations to reinforce positive money beliefs

- Build an emergency fund to reduce financial anxiety

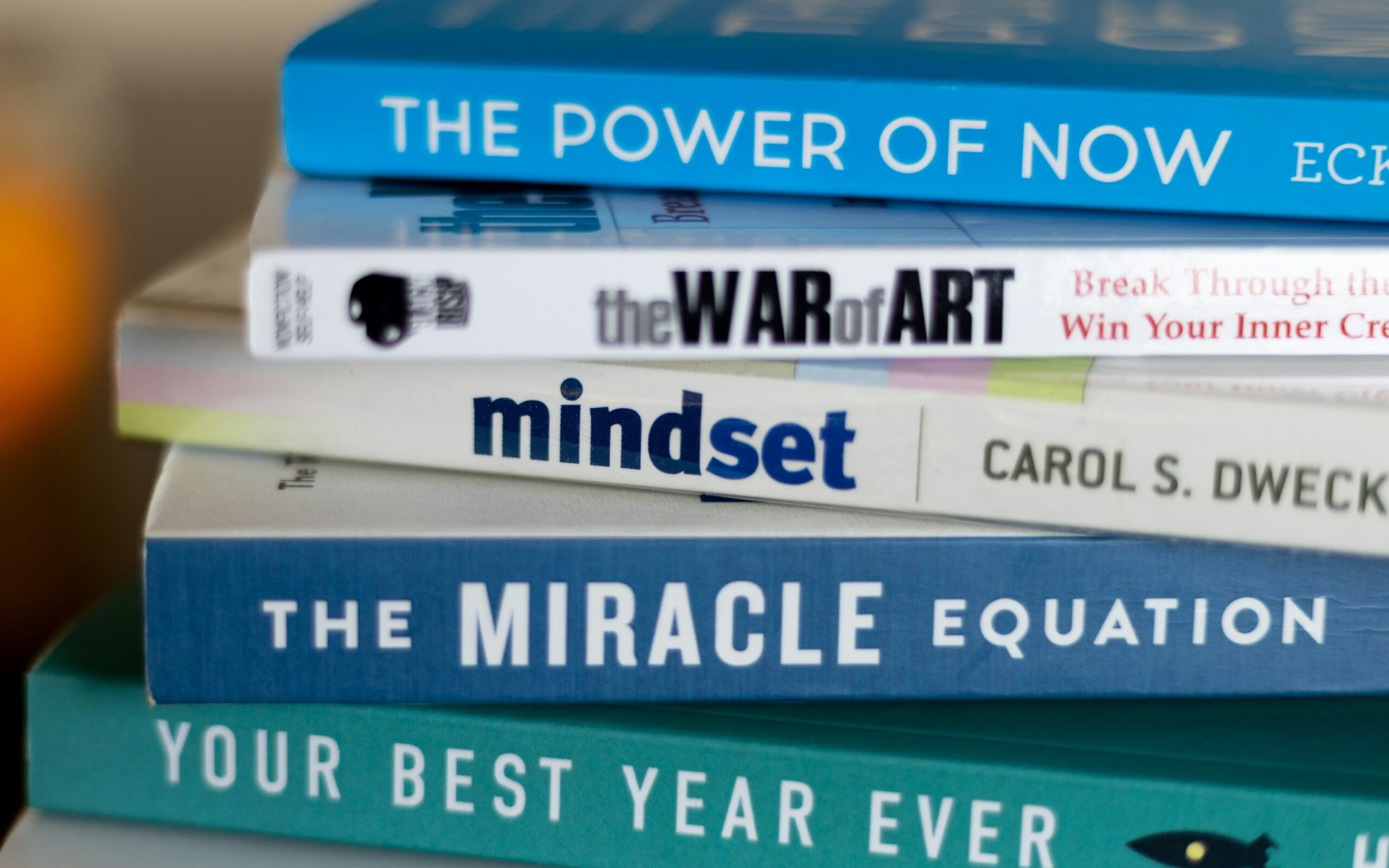

- Read personal finance books to expand your knowledge

- Start small with side hustles to build confidence

- Learn how to create your first budget to take control

Closing Thoughts: Transform Your Mindset, Transform Your Finances

Your financial journey is not just about numbers—it’s about the beliefs and habits that shape how you approach money. By shifting from a fixed mindset to one of growth and abundance, you can unlock new possibilities and take control of your financial future.

Remember, change doesn’t happen overnight. It takes time, effort, and a willingness to challenge old beliefs. But every small step you take brings you closer to your goals, and soon, you’ll see how much your mindset has transformed your financial reality.

So, take action today. Whether it’s setting a new financial goal, tracking your expenses, or simply affirming your belief in your ability to succeed, every effort counts. Keep growing, keep learning, and most importantly, keep believing in your financial potential.

Your mindset is the foundation for all your future financial success. Embrace it, and watch your wealth—and confidence—grow.

Frequently Asked Questions About Financial Mindset and Overcoming Limiting Beliefs

How long does it take to change my financial mindset?

Changing your mindset is a gradual process. Most people start seeing meaningful shifts in 3-6 months of consistent practice. It’s about building new neural pathways through repetition and conscious effort. Be patient with yourself and celebrate small wins along the way.

Can I really change my subconscious beliefs about money?

Absolutely! Neuroplasticity proves our brains can rewire themselves. Through techniques like affirmations, visualization, and mindful awareness, you can gradually replace limiting beliefs with empowering ones. It takes consistent practice, but change is absolutely possible.

What’s the difference between a fixed and growth mindset?

A fixed mindset believes abilities are static, while a growth mindset sees potential for development. In financial terms, a fixed mindset might say “I’m not good with money,” while a growth mindset says “I can learn to manage money effectively.” The growth mindset opens more opportunities.

How do I identify my limiting financial beliefs?

Start by journaling about your money memories. Ask yourself what your parents taught you about money, what emotions arise when discussing finances, and what automatic thoughts appear when making purchases. These patterns reveal your subconscious programming.

Are positive affirmations really effective?

Yes, when done correctly. Effective affirmations are specific, present-tense, emotionally resonant, and repeated consistently. Instead of “I want to be rich,” try “I am building wealth through smart financial decisions every day.”

How can I overcome fear of financial failure?

Start small with low-risk financial experiments. Build an emergency fund for security. Reframe failures as learning opportunities. Celebrate small wins to build confidence. Remember that every successful person has faced setbacks.

Can an abundance mindset actually improve my finances?

Research shows a direct correlation. An abundance mindset reduces stress-driven decisions, increases openness to opportunities, improves risk assessment, and enhances creativity in problem-solving. These factors directly impact your financial outcomes.

What’s the first step to developing a better financial mindset?

Self-awareness. Start by tracking your money thoughts for one week. Notice patterns, triggers, and emotional responses. Identify one limiting belief to challenge. Reading personal finance books can also provide new perspectives and strategies.